tax on unrealized gains uk

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. The investor can plan when to sell the security and realize his gains.

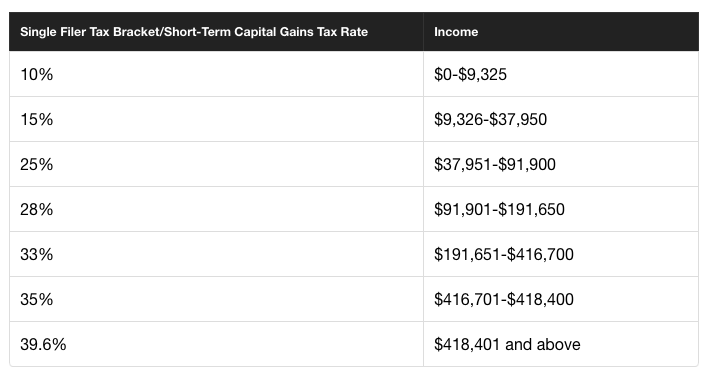

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

This reflects the 10k investment and the 5k unrealised gain.

. Its the gain you make thats taxed not the. You buy 1 ETH for 4000. And the value of their unrealized gains differs significantly about 100000 for the bottom 20 versus 17 million for the top 10 on average according to the Federal Reserve.

The price of BTC has increased by 3000 but you havent sold your asset. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Limited company made 100k of investments during its company year - all investments in publicly traded shares not funds or unit trusts they bought shares directly in companies.

For these 13 billionaires total unrealized gains add up to more than 1 trillion. 716 pm EST. Realizations would fall so much that it would more than offset the revenue produced by the higher tax rate.

Households worth 100 million or more is drawing skepticism from tax experts. An unrealized gain is a profit that exists on paper resulting from an investment. Thus by knowing the Unrealized Gain the Company can forecast the amount of tax to be paid if they sell the securities.

Thus by knowing the Unrealized Gain the Company can forecast the amount of tax to be paid if they sell the securities. Holding security for a long time may reduce the tax implication as it will be treated as long-term capital gains tax. Theyre usually used as collateral to borrow money.

Will the Unrealized Capital Gains Tax Proposal Apply to Most Investors. But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. You have an unrealized gain of 3000.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. According to the ATAD Directive the tax levied on unrealized capital gains is intended to ensure that if a taxpayer moves assets or its tax residence out of the tax jurisdiction of a state that state is allowed to tax the economic value of any capital gain created in its territory even though that gain has not yet been realized at the time of the exit. You have a realized loss of 500.

The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate see BIM39510. The proposal would allow billionaires to pay this initial tax. I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k.

This means that tax liabilities can arise from exchange gains which are unrealised and so are unfunded. By Rachel Warren Brian Withers and Trevor Jennewine - Nov 16 2021 at 815AM. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax. The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. A new tax could require the wealthy to pay least 20 even on unrealized appreciation.

Taxes are paid only on realized gains. You will then be subject to taxation assuming the assets were not in a tax-deferred account. A further complexity arises in the UK as tax is calculated on an individual entity basis.

Taxing unrealized capital gains at death theoretically increases the revenue-maximizing. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. Approach at crypto tax software application specialist CoinTracker.

Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed that capital gains are the result of earnings made through the sale an asset such as stocks real estate stock or a company and that these profits constitute taxable income. Under FRS102 we need to show the investments at market value at year end which is easy to do as they are publicly. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains.

The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue. Currently assets like that are only taxed when theyre sold. John Gimigliano the head of.

You later sell your ETH for 3500. You buy 1 ETH for 4000. Unrealised gains on investment shares - is Corp tax chargeable.

When it comes down to determining the amount you have to pay tax on these gains a lot depends on the. However it was my understanding that unrealised gains of this nature should be stripped out of the calculation for Corporation Tax. Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run.

The top 0002 will be taxed yearly on unrealized gains from stocks and bonds. Capital Gains Tax is a tax on the profit when you sell or dispose of something an. You buy 05 Bitcoin for 30000.

March 26 2022 229 PM PDT. Households worth more than 100 million as. It can potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax obligation.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Capital Gains Yield Cgy Formula Calculation Example And Guide

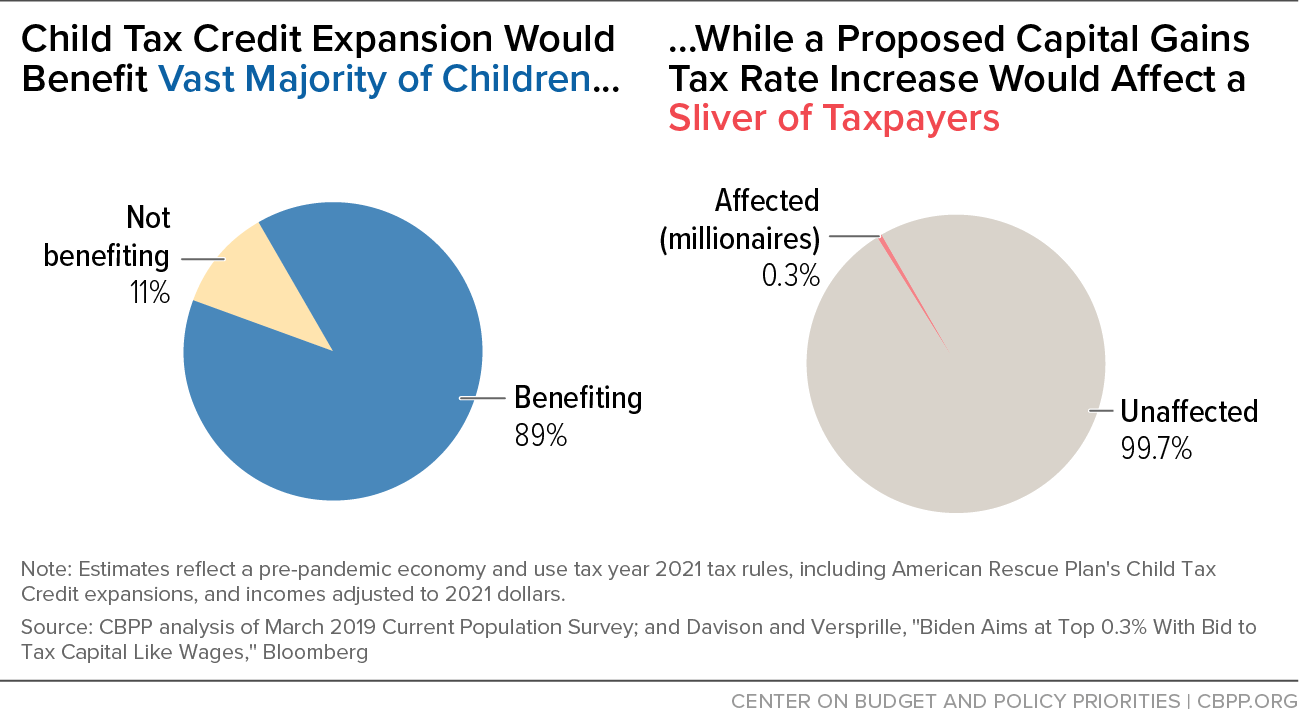

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

The Overwhelming Case Against Capital Gains Taxation

12 Ways To Beat Capital Gains Tax In The Age Of Trump

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Day Trading Don T Forget About Taxes Wealthfront

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

The Unintended Consequences Of Taxing Unrealized Capital Gains

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Enjoy The Etf Tax Dodge While You Can

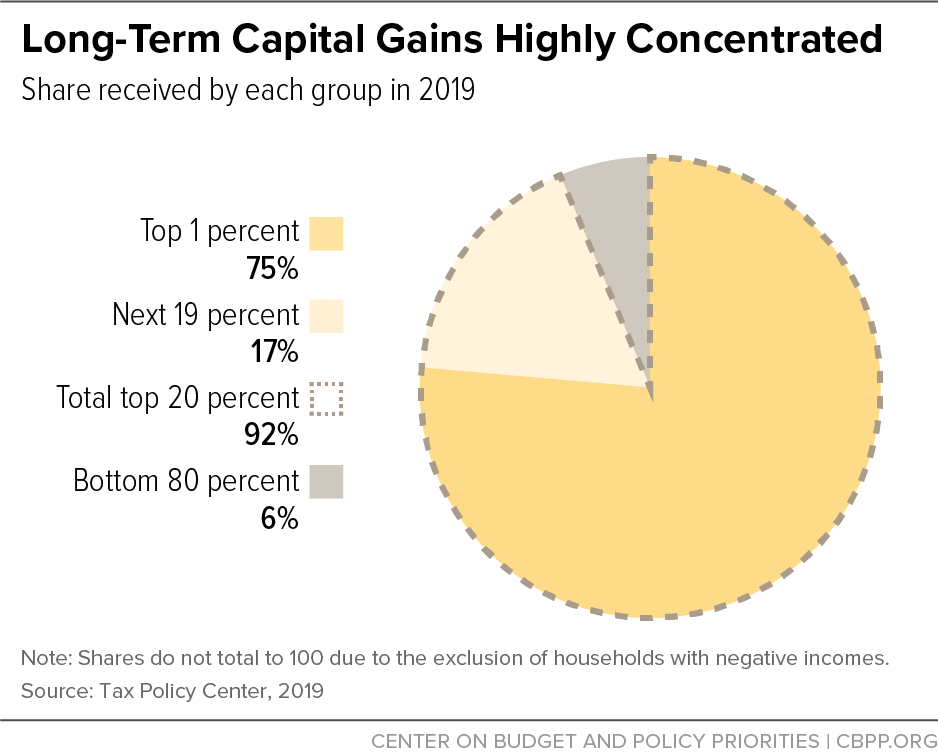

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)